Challenge

Redburn is Europe’s largest independent equities broker, providing institutional investors such as investment banks and hedge funds with equity research and agency execution in Pan-European equity markets. The firm, headquartered in the City of London in the UK, employs around 200 people worldwide.

Redburn’s clients pay for equity research out of the management fees they charge to their clients. In January 2018, the European Commission introduced new regulatory requirements under the Markets in Financial Instruments Directive (MiFID) II, to increase transparency and trust around financial investments and increase protection for those investing. This places new expectations on financial institutions and their service providers to be clearer about their business models and more detailed in their charging structures, so that clients can see exactly what they are paying for.

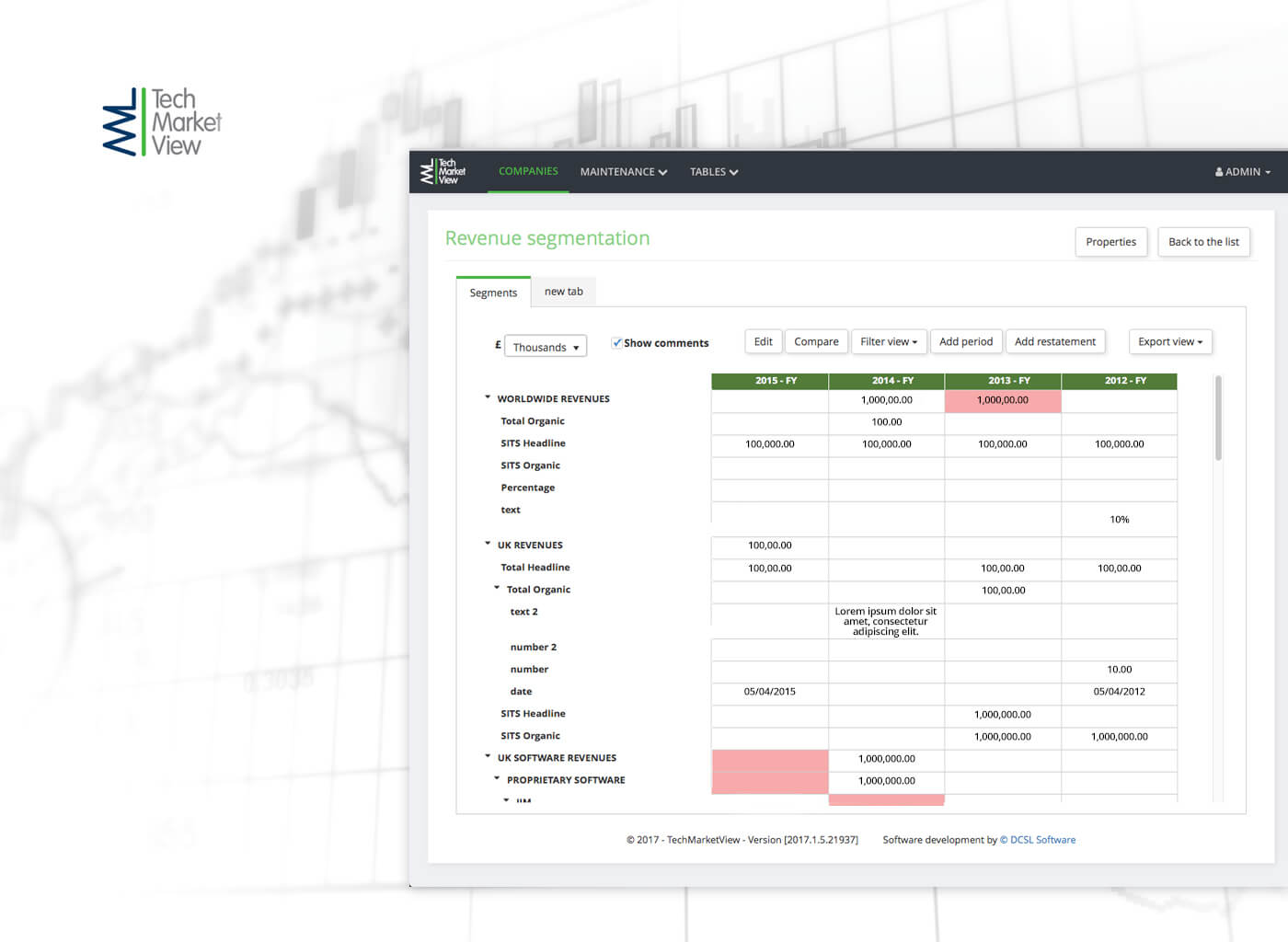

Although Redburn already had an established methodology for pricing its research, this was managed largely via spreadsheets and accessible primarily by the company’s customer relationship management (CRM) and pricing teams. To comply with MiFID II, the firm needed to make detailed pricing information more widely accessible for review by all client-facing and admin teams – about 150 people internationally.

“We needed to industrialise our pricing methodology, and give more people secure and fast access to all the detail they needed in a user-friendly format,” explains Matthew Norman, Redburn’s Head of IT. “The system also needed to be able to cater for what could be weekly or even daily changes to pricing information, and be able to track those changes.”

Because the MiFID II regulation transforms the way financial research is justified and paid for, Redburn needed the new pricing system to support retrospective as well as future client negotiations. Teams needed to be able to review historical charges and pricing changes, and track the specifics of pricing calculations, such as the breakdowns of time spent for each client. Meanwhile analysts needed to be able to add details of the services they were providing, to support this granular billing. “We operate in a very data-driven world now which means clients are likely to be logging all of this information too, so it’s crucial that our accounts tally,” Mr Norman notes.

Because MiFID II is a new regulatory requirement, it wasn’t obvious where to go for a suitable software system for managing pricing. Redburn would have preferred to keep any bespoke development in house because it did not want to share details of its pricing methodology, which is commercially sensitive information. Yet its IT department did not have the capacity to run a new project internally. It needed to find a trusted external partner.

Solution

Keen to avoid the high costs of a central London software development company, Redburn set out to find a reputable firm in the wider M25 area. When it came across One Beyond online, it sounded like the perfect fit, which was confirmed when Mr Norman went to visit the team.

“We liked their collaborative and agile approach to development, which is how we work internally,” he says. “We knew that the needs of our CRM team were likely to keep evolving and changing, so this was going to be important. One Beyond also use the same sort of technologies that we do internally, so it was a great match. We liked their proposal and demo, and the price which was very competitive.”

Redburn’s IT team had a good idea of the system specifications it wanted, but was open to One Beyond’s suggestions about its look and feel, and workflow. The close proximity between the two companies meant that One Beyond’s project manager was able to hold regular meetings with the CRM team to ensure that the pricing system did everything they needed it to, and that the finished product would be something they would willingly use. “The meetings were very beneficial,” Mr Norman says.

One Beyond built the desktop system using Microsoft’s Asp.Net MVC web application framework. It is accessible over the secure company intranet, via user authentication, and integrated with Redburn’s CRM system.

Outcome

The new company-wide pricing system, which has already been rolled out to the CRM team, has received impressive feedback for its accurate methodology and calculations, its look and feel, and its speed. “It helps that the users have been proactively involved the whole way through, which has resulted in a system they feel very comfortable with,” Mr Norman notes.

Of the system’s strategic importance to Redburn, he says, “It is critical to our pricing strategy, to our compliance with the new MiFID II regulation, and to our client relationships. We will use it to support all future negotiations, and to demonstrate to existing clients exactly how their money has been spent, giving them the visibility and detail they need to report back to their own clients.”

One Beyond, which will also support the software, will continue as a strategic software partner to Redburn. “This initial project has already highlighted other things we need to think about, so there will be a Phase 2 and a Phase 3,” Mr Norman concludes. “And the regulatory landscape and research pricing are always changing, so the system won’t stand still. Luckily, we’re in the best possible hands – One Beyond knows the software inside out, is readily on hand and offers excellent value for money.”